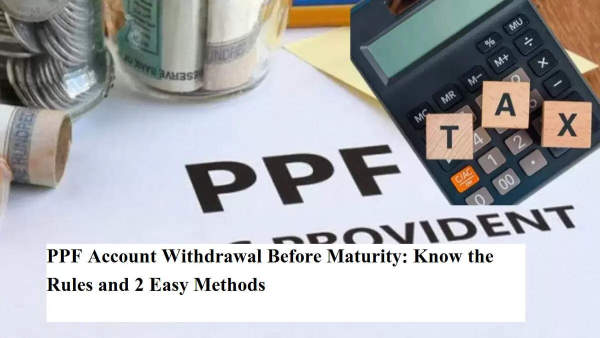

The stock market is often seen as a place of high returns — and high risk. For investors who suffer losses, the search for safer, guaranteed options becomes essential. One such low-risk, government-backed savings scheme is the Public Provident Fund (PPF).

Why Investors Prefer PPFPPF is a favorite among conservative investors due to:

-

Low risk

-

Guaranteed returns

-

Tax-saving benefits under Section 80C

-

15-year lock-in with fixed interest

However, emergencies don’t wait for maturity. So, if you need money before your PPF account matures, the government does allow partial withdrawals, but under specific rules.

Can You Withdraw Money from PPF Before 15 Years?Yes, early withdrawal from a PPF account is permitted under the PPF scheme, but it comes with certain conditions and limits.

✅ Rules for Early Withdrawal from PPFPartial withdrawals are allowed only from the 7th financial year onward.

-

For example, if you opened your account in FY 2018–19, you can withdraw in FY 2025–26.

Maximum withdrawal limit:

-

You can withdraw up to 50% of the account balance as of:

-

The end of the 4th financial year, or

-

The end of the preceding year, whichever is lower.

-

Only one withdrawal is allowed per financial year.

-

Visit the bank or post office where your PPF account is held.

-

Fill out Form C (PPF Withdrawal Form).

-

Submit along with your passbook and ID proof.

-

The request is usually processed within a few days.

-

Log in to your bank’s net banking portal (available only if PPF account is linked).

-

Navigate to the PPF account section.

-

Select ‘Withdraw Funds’ or similar option.

-

Enter amount and confirm withdrawal.

-

Funds are typically credited to your linked savings account.

-

Early withdrawal does not affect account validity.

-

The remaining balance continues to earn interest.

-

Avoid withdrawing unless absolutely necessary to maximize long-term returns.

While it’s advisable to let your PPF account mature to gain the full benefits, the government’s rules do allow for some flexibility during financial emergencies. By understanding the eligibility and limits, you can plan better and make informed financial decisions when needed.

PPF is a safe haven for those seeking assured returns with tax benefits — just ensure your withdrawals are timely and justified.