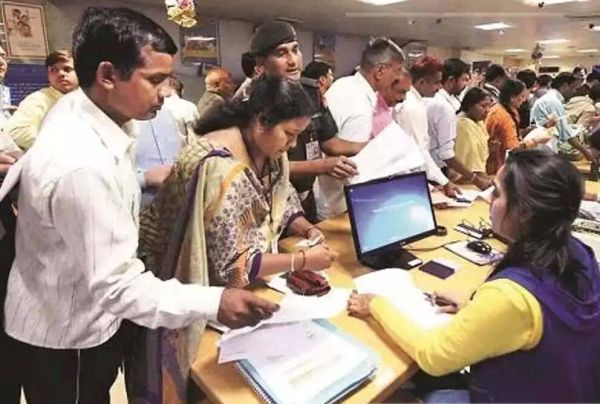

Major banks of India such as State Bank of India (SBI), Punjab National Bank (PNB), and HDFC Bank have announced a change in their minimum balance rules, which will be applicable from 1 April 2025. This change will affect the account holders of urban, semi-urban, and rural areas. If you are also a customer of these banks, then it is necessary to understand the new conditions and avoid penalty. Let us know in detail these changes and understand how you can keep your money safe.

Minimum balance in SBI: What is the new rule?

Since 2020, State Bank of India had abolished the requirement of minimum balance for its regular savings accounts, which gave relief to millions of customers. However, there are some unconfirmed reports on social media that from April 2025, SBI can increase the minimum balance from ₹ 0 to ₹ 1,000. The bank has not yet officially confirmed this, but experts recommend that customers regularly check their account status. If you are beneficiaries of government schemes, then Zero Balance accounts of SBI can be a better option for you. This rule is especially beneficial for students and low income people.

HDFC Bank: Strict rules, more penalty

The terms of the minimum average monthly balance (Amb) at HDFC Bank are already strict. Customers in urban areas will have to maintain a balance of ₹ 10,000 and ₹ 5,000 in semi-urban areas. According to unconfirmed reports, this limit may increase after April 2025. If you do not maintain this balance, you may have to pay a penalty of 6% or a maximum of ₹ 600. For example, if your balance falls to ₹ 8,000, you may have to pay a penalty of ₹ 300. Experts say that if you have a fixed deposit (FD) of ₹ 1 lakh, then you can get exemption from the condition of minimum balance.

PNB: Different rules in rural and urban areas

Punjab National Bank has set its minimum quarterly average balance (QAB) ₹ 3,000 in urban areas, ₹ 2,000 in semi-urban areas, and ₹ 1,000 in rural areas. There is a discussion on social media that this limit can increase to ₹ 5,000 from April 2025. If you do not maintain this balance, then a penalty of ₹ 400 to ₹ 600 can be imposed. PNB has earned ₹ 1,538 crore from penalty to not keep the minimum balance in the last five years, showing that customers need to be vigilant.

Easy ways to avoid penalty

Amidst these changes, you can avoid penalty by taking some smart steps. First of all, get information about the latest rules from the official website or branch of your bank. If your account is not able to maintain minimal balance, consider switching to the zero balance account. Also, set an automated transfer, so that you always have enough balance in your account. If you have an additional amount, invest in fixed deposits (FD), as many banks give exemption to FD holders in terms of minimum balance.

Why is it necessary to stay updated?

In the last five years, banks have earned ₹ 8,500 crore from penalty to not keep minimum balance, which shows how important this rule is for customers. The Reserve Bank of India (RBI) has not yet issued any official statement on these changes, but experts say the policies of banks change, and customers should be cautious. You can avoid unnecessary expenses by regular monitoring of your account and contacting the bank directly.