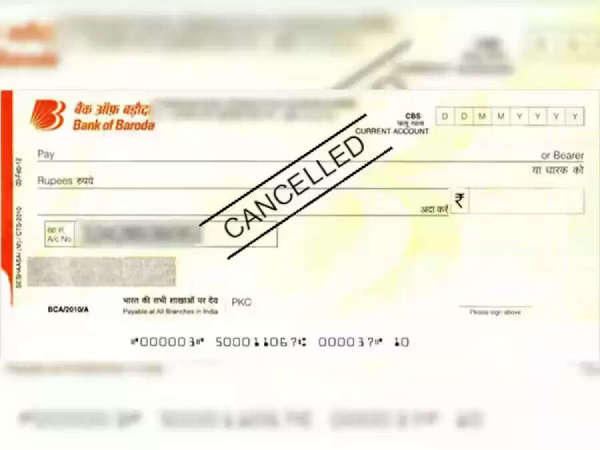

Bank Cheque Tips: Cheques are still an important part of the banking system. Be it a business transaction or personal payment, people still rely on cheques for big transactions. But cheques are a very sensitive document, in which even a small mistake can get your money stuck. Many times people make such mistakes in carelessness which directly become the reason for cheque bouncing. Cheque bouncing not only damages your reputation but it can also be a legal offence.

The date written on the cheque is the first thing that the bank checks while clearing the cheque. The validity of a cheque is only 3 months. If an old or wrong future date is written, then the cheque may be rejected. If you are giving a Post-Dated Cheque (PDC), then the cheque will not be cleared before the due date.

The name of the person or company to whom the payment is to be made in the cheque should be written clearly and correctly. Avoid any kind of overwriting. Even a spelling mistake in the name can result in the cheque being cancelled. Just "Bearer" or "Self" can also be written, but clarity is important.

The amount is written twice in the cheque – once in numbers (₹25000) and second time in words (Rupees Twenty-Five Thousand Only). There should be no difference between the two.

Your signature should match your bank records. In case of a mismatch, the bank rejects the cheque. Overwriting or error in the signature can also cause the cheque to bounce.

If the account does not have the amount mentioned in the cheque, then it becomes the biggest reason for the cheque to bounce. This not only causes financial loss but can also lead to legal action under Section 138 of Negotiable Instruments Act.

A cheque is a sensitive document. Any deletion, addition or repeated writing in any entry is considered suspicious. This makes the bank think that the cheque has been tampered with, and the cheque gets rejected.

There is a micro-printed lining at the bottom of the cheque which contains bank details, cheque number, IFSC code etc. If this part gets dirty or torn, the cheque will not be read and will get rejected.

If you want the cheque to go to the account of that person only, then definitely write ‘A/C Payee’ and ‘Crossed Cheque’ on the cheque. This reduces the chances of the cheque going into the wrong hands.

Fill the blank space on the cheque or draw a line, so that no one can add anything later. This is an important security measure which can be risky to ignore.

Many times people fold the cheque and keep it, due to which it gets damaged.

Due to this, the bank machines are unable to scan it and reject it.