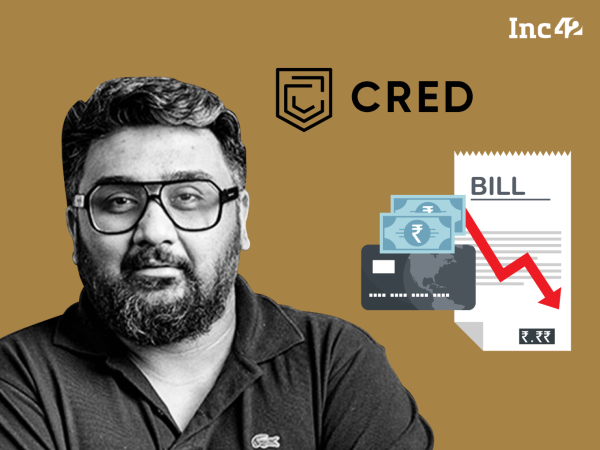

Kunal Shah-led fintech unicorn CRED has raised INR 617 Cr (about $72 Mn) in a down round led by Singapore sovereign wealth fund GIC’s Lathe Investment.

In what appears to be a Series G round, the fintech major raised the capital at a valuation of $3.5 Bn, down nearly 45% from $6.4 Bn at which it was last pegged in 2022.

As per its filings with the Registrar of Companies (RoC), GIC spearheaded the round with a total investment of INR 354.4 Cr. RTP Capital and Sofina poured INR 74.9 Cr and INR 25.9 Cr, respectively. Meanwhile, founder and CEO Shah-owned investment vehicle QED Innovation Labs invested INR 162.1 Cr in the round.

The fundraise comes a couple of months after reports first surfaced that the from investors, including Peak XV Partners, Tiger Global, Ribbit Capital at a post-money valuation of $4 Bn.

As per Economic Times, the fintech major took the hefty valuation cut as it is exploring a potential initial public offering (IPO) in the next two years. CRED clocked $6.4 Bn valuation in 2022 when it bagged $140 Mn in its Series F round. It is pertinent to note that GIC led that round too.

Since its last fundraise, the startup has been working aggressively to launch new offerings and bolster its top line despite deepening losses. In FY24, CRED’s operating revenue zoomed 71% to INR 2,397 Cr from INR 1,400 Cr in FY23. Meanwhile, losses rose 22% year-on-year (YoY) to INR 1,644 Cr in the fiscal under review.

CRED is yet to file its financial results for FY25.

Nevertheless, the past one year has seen the startup focussing its energies on expanding its product stack to shore up its super app ambitions. Here’s a brief look at what the startup has been up to in recent times:

- In May 2025, the and Spinny to enable users to sell their cars on its platform

- Doubling down on its credit vertical, , credit score checker CRED Credit Score, among others, under ‘Svalbard’

- In January 2025, in collaboration with the Reserve Bank of India (RBI), becoming the first fintech startup to introduce Central Bank Digital Currency (CBDC)

- In November 2024, the in partnership with three insurance companies through its vehicle management platform CRED garage

The funding round also comes at a time when big-ticket startups are facing valuation challenges as investors tighten their purse strings. Earlier this month, B2B ecommerce major at a likely flat valuation of $1.8 Bn.

In April, fintech startup Jar’s $50 Mn funding deal with a clutch of investors, led by Prosus, reportedly . In March, Temasek-owned Fullerton Financial Holdings acquired a controlling 55.57% stake in Lendingkart for INR 252 Cr, as against its peak valuation of $350 Mn in 2020.

The post appeared first on .