The Flipkart Axis Bank Credit Card is a joint offering from Axis Bank and Flipkart, designed to cater to the needs of avid online shoppers. Packed with cashback rewards, welcome bonuses, and additional perks, this credit card enhances your shopping experience on Flipkart and partner platforms like ClearTrip. Here's a detailed overview of its charges, features, eligibility, and more.

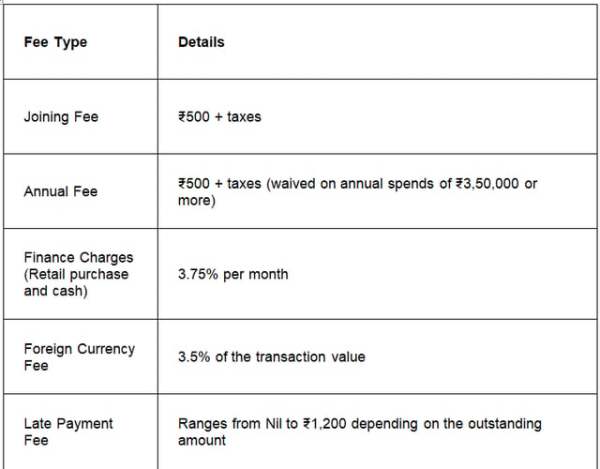

Fees and Charges

The comes with affordable fees, making it accessible to a wide range of users. Here’s an overview:

*Disclaimer: The mentioned rates are subject to change at the issuer’s discretion.

Key Features of the Flipkart Axis Bank Credit Card

Here are some important details of this that you should know about:

Cashback Rewards

The Flipkart Axis Bank Credit Card offers one of the most rewarding cashback programs for online and offline spends:

● 5% Cashback: On purchases made on Flipkart and ClearTrip

● 4% Cashback: On transactions with select partners, including Swiggy, Uber, PVR, and Cure.fit

● 1% Cashback: On all other eligible spends

Note: Cashback is directly credited to your statement, ensuring you can easily track your savings.

Welcome Benefits

New cardholders can enjoy exciting benefits, including:

● ₹500 Flipkart Voucher: Available on completing the first transaction within 30 days of card issuance

● Swiggy Offer: Get a 50% instant discount of up to ₹100 on your first Swiggy order using the promo code ‘AXISFKNEW’

Wednesday Delight

You can get special offers by using this Axis Bank credit card on a Wednesday. These are as follows:

● Tira: 10% off up to ₹1,000 on every purchase

● MakeMyTrip and Goibibo: 15% off on hotel and flight booking

● Swiggy and Amazon Fresh: 10% off on orders

Other Privileges

Some other miscellaneous benefits you can enjoy with this card are as follows:

● Airport Lounge Access: Cardholders can access four complimentary domestic lounge visits per year, with a quarterly cap of one visit. A minimum spend of ₹50,000 in the previous 3 months is required to get this benefit.

● Fuel Surcharge Waiver: Enjoy a 1% waiver on fuel transactions between ₹400 and ₹4,000, with a maximum benefit of ₹400 per statement cycle

● Dining Discounts: Get up to 15% off at select partner restaurants through Axis Bank’s Dining Delights program

● Convert to EMI: Enjoy easy EMI offers on Flipkart for a credit card purchase of a commodity worth ₹2,500 or more

Eligibility Criteria and Documents Required

To apply for the Flipkart Axis Bank Credit Card, you must meet these requirements:

● Age: Applicants should be between 18 and 70 years

● Residency: The applicant must be an Indian resident

● Income: A steady income source is required

Do note that the approval of your credit card application is dependent on the discretion of the issuer. There may be some other requirements you may have to fulfil to be eligible for this card. Reach out to Axis Bank to get a complete list of the criteria before applying.

Alongside meeting the eligibility criteria, you may be asked to provide the following documents when applying for the card:

● PAN card or Form 60 (As applicable)

● Income proof like your latest payslip, Form 16, and ITR filing

● Address proof like your utility bill and driving licence

Benefits of the Flipkart Axis Bank Credit Card

The advantages of opting for this card are as follows:

Seamless Cashback Experience

Cardholders can save significantly on every purchase, especially if they are frequent shoppers on Flipkart and ClearTrip. The cashback is directly credited to the statement, ensuring no hassle of redemption.

Access to Premium ExperiencesEnjoy exclusive benefits like airport lounge access and dining discounts, making this card ideal for those who travel or dine out frequently.

Budget-friendlyWith a joining fee of just ₹500 and the potential to waive the annual fee, this card offers substantial value at a minimal cost.

Wide UtilityApart from Flipkart and ClearTrip, you also earn rewards for transactions with a host of other partners.

Who Should Consider Getting This Credit Card?

The Flipkart Axis Bank Credit Card is perfect for:

● Online Shopping Enthusiasts: Frequent shoppers on Flipkart will maximise rewards

● Casual Spenders: With cashback on all eligible transactions, even casual users can benefit

● Travel and Dining Lovers: Premium features like airport lounge access and dining discounts add value for lifestyle users

The Flipkart Axis Bank Credit Card is a robust offering for individuals who wish to save more while spending on essentials and luxuries. Its combination of cashback, welcome bonuses, and premium perks ensures excellent value for both avid and casual shoppers.

When considering this card, assess your shopping and spending habits to ensure it aligns with your needs. With simple eligibility requirements and a seamless application process, this card could be your next smart financial move.