The Union Finance Minister has presented the general budget by Nirmala Sitharaman, in which the government has given great relief to the taxpayers. Along with this, he also said to present the new tax law next week. In the budget, the government has not imposed any tax on income of up to 12 lakhs. This means that if standard deduction is added to 75 thousand, then those who earn up to 12.75 lakhs will not have to pay any tax. The government will increase the tax free income limit. It was being discussed even before the budget. The central government had also indicated this. The Finance Minister relieved 12.75 lakh people from tax, but it is under the New Tax Resetam. If you adopt Old Tax Resetam, then you will not get any benefit. Let's understand it with details.

In the budget, the Finance Minister has made tax free to earn 12.75 in total. They will not have to pay even one rupee tax. But at the same time, if a person has chosen Old Tax Resetam, then he will not get any benefit from the announcement made in the budget. Because the government did not announce anything about the old tax regime. The Finance Minister did not even touch him.

Whatever exemption will be given in tax, taxpayers adopting new tax resume will be available. However, it was being speculated that the government would make some announcements to promote the new tax regime, but there was no decision on the Old Tax Regim. In the budget, the government has given a tax exemption in the new tax regime only to promote the consumption and it is expected that in the new tax law too, the government will promote the new tax regime.

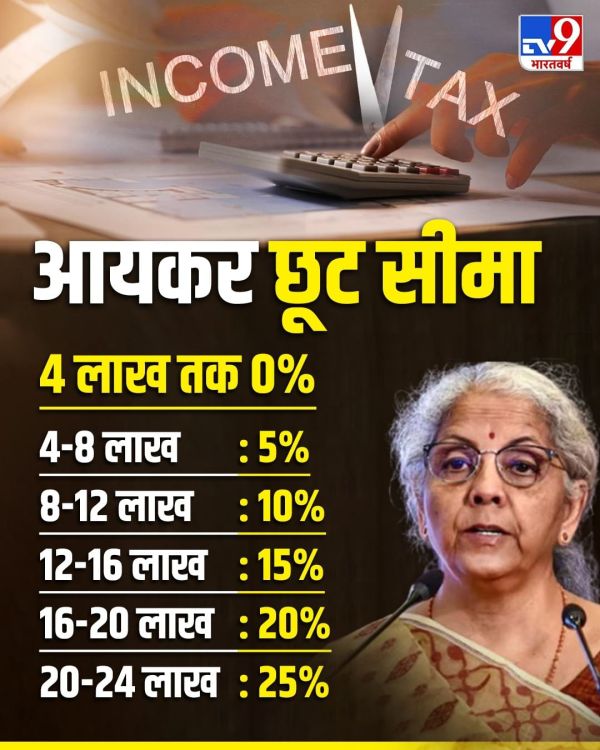

Tax slab under New Tax Regime

If you talk about tax slab under New Tax Regime, then the government fixed 0 % tax on income of up to 4 lakhs, 5 % tax on those earning 4 to 8 lakhs and 10 percent tax on income of 8 to 12 lakhs Has done At the same time, 15 percent has been fixed for those earning 12 to 16 lakh annually, 20 percent on income of 16 to 20 lakhs and 25 percent income tax on 20 to 24 lakh people. But you do not have to be confused by seeing it. Till 12.75 lakh income, you will not have to pay tax from your pocket, because even the government will rebate on tax. Those who have been fixed at less than 12 lakhs. Based on them, tax will be fixed on earnings of more than 12.75 lakhs.

Old Tax Reseed System

In the budget 2025, the hands of taxpayers with Old Tax Reseam are empty. The government has not given them tax exemption. Nor has been announced about them. Under the old tax system, there is no income tax on annual income up to Rs 2,50,000. At the same time, 5% tax is applicable between Rs 2,50,001 to Rs 5,00,000. Along with this, 20% tax is levied between Rs 5,00,001 to Rs 10,00,000 and 30% tax is levied on more than Rs 10,00,000 i.e. Rs 10,00,001 and more. The government has neither changed these slabs nor has given any tax exemption.